Have you ever been in a situation where you have had the money needed to buy something, maybe a new bed for your child or a new gaming system for you and your significant other, but the store will not take cash, or you can only buy it online? But, you do not have a credit card or a debit card that you can use? Maybe you are not a fan of credit cards or have a poor credit history or you are not getting approved for traditional credit cards. If any of these situations sounds familiar, a credit builder loan may be in your future.

Why Choose Credit Builder Loans and Credit Strong for Building Your Credit

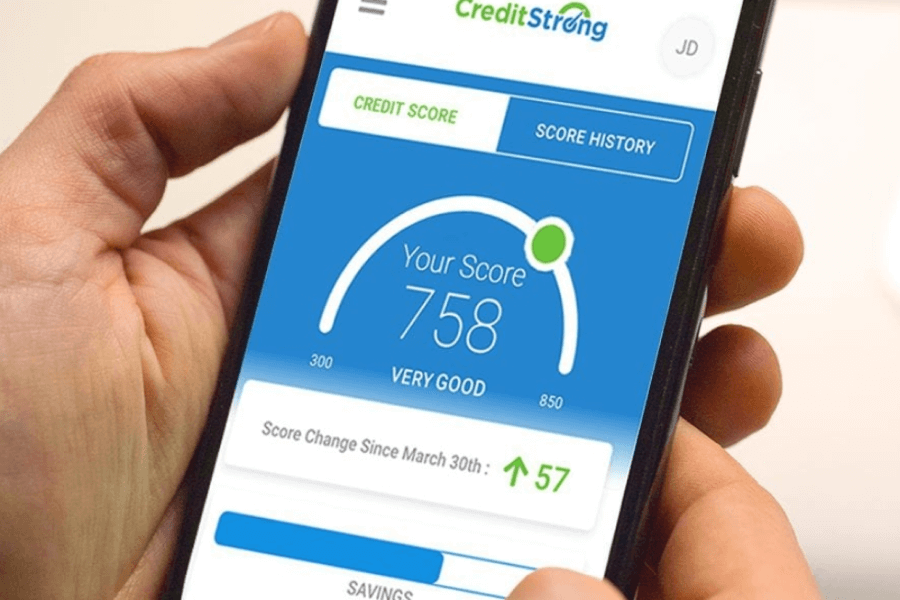

A credit builder loan emerges as the most effective option for individuals with limited or no credit history. Unlike secured credit cards or authorized user arrangements, a credit builder loan offers a structured path that combines building credit and savings simultaneously. This specialized type of loan ensures that each on-time payment made is reported to major credit bureaus, establishing a positive payment history and gradually bolstering the borrower’s credit profile. Moreover, the funds secured in a bank account or CD serve as a safety net, providing a valuable savings buffer to support the borrower’s financial journey. With the introduction of Credit Strong, a trustworthy and comprehensive platform, individuals can embark on their credit-building journey with confidence, knowing that they have a dedicated partner in their pursuit of financial strength.

What is a Credit Builder Loan?

A credit builder loan is a specialized type of loan designed for individuals with limited or no credit history. Unlike traditional loans, the borrower doesn’t receive the funds upfront. Instead, the borrowed amount is secured in a bank account or CD by the lender. The borrower then makes regular monthly payments on the loan for a predetermined period, typically ranging from six to twenty-four months. Think of it almost as opening a savings account, except with a credit builder loan, the main purpose is to build your credit profile. You get the benefits of having money in a secure account that will be there when you need it, as well as helping you to improve your credit score and create a history. It gives you an opportunity to show that you can consistently make on-time payments, which will help you establish the qualities needed for a good credit history.

How Credit Builder Loans Work

Credit builder loans can be looked at as a path to better credit. The beauty of credit builder loans lies in their dual purpose: building credit and boosting savings. Each on-time payment made by the borrower is reported to at least one major credit bureau, such as Experian, Equifax, or TransUnion. This positive payment history demonstrates responsible credit management, gradually establishing a credit profile.

Moreover, the funds held in the savings account or CD serve as a safety net. As the borrower makes timely payments, the lender gradually unlocks the funds. At the end of the loan term, the borrower receives the full loan amount minus any fees or interest charged by the lender. This creates a savings buffer that can be used for emergencies or other financial goals.

Introducing Credit Strong: Your Trusted Partner in Credit Building

Start Building Credit Today

- No Credit Check

- Multiple Loan Options

- Build Your Savings

Start Building Credit Today

- No Credit Check

- Multiple Loan Options

- Build Your Savings

Credit Strong is a division of a FDIC-insured independent community bank, assuring that your personal and credit information is secure, and your money is safe. It’s more than just a credit builder loan; it’s a comprehensive platform dedicated to your financial growth.

How Credit Strong Works

Credit Strong’s innovative platform offers a seamless and effective way to build credit and savings hand-in-hand. With three powerful accounts – Revolv, Instal, and CS Max – tailored to specific credit-building needs, Credit Strong empowers individuals to take control of their financial journey. They have three specific account types for you to choose from for your credit builder loan. You can decide which one works best for your needs.

Revolv Account: Instantly Build Revolving Credit

With the Revolv account, you can instantly establish a revolving credit line of $500. The borrowed funds are securely locked in a deposit account, allowing you to optimize your credit utilization. Making on-time payments is key to improving your payment history, showcasing your responsible credit management. The best part? No monthly payment is required, and 100% of your monthly payment goes towards building your savings. As you progress, your credit history strengthens, and the locked funds serve as a valuable financial cushion for future needs.

What makes Revolv stand out:

-

Instant Revolving Credit

The Revolv account offers an immediate revolving credit line of $500, providing you with the opportunity to start building credit right away. -

Optimized Credit Utilization

By using the Revolv account responsibly, you can optimize your credit utilization, which is a crucial factor in determining your credit score. -

No Monthly Payments

Unlike traditional credit cards, the Revolv account doesn't require monthly payments, making it easier to manage your finances while building credit. -

100% Savings Building

Every monthly payment you make on the Revolv account goes directly towards building your savings, helping you establish a financial safety net.

Instal Account: Flexible Installment Credit and Savings Building

Credit Strong’s Instal account provides a flexible path to build installment credit and savings simultaneously. You can choose a plan that aligns with your budget, spanning over 24, 36, or 48 months. Making on-time payments on your Instal account establishes a positive credit history, showcasing your reliability as a borrower. As the account matures, your savings grow in tandem, and once the term is completed, the locked funds are unlocked, providing you with access to your savings.

What makes Instal stand out:

-

Flexible Payment Plans

The Instal account offers the flexibility to choose from 24, 36, or 48-month payment plans, allowing you to find a timeframe that fits your budget. -

Establish Positive Credit History

Making on-time payments on the Instal account helps you establish a positive credit history, showcasing your creditworthiness to potential lenders. -

Simultaneous Savings Growth

As you progress with your Instal account, your savings grow in tandem, providing you with a valuable savings buffer at the end of the term. -

Unlocking Savings

Upon completing the account term, the locked funds are released, giving you access to your savings, which can be used for emergencies or other financial goals.

CS Max Account: Unlocking Larger Credit Opportunities

For individuals seeking larger credit opportunities, the CS Max account is the perfect fit. These accounts report up to $25,000 of installment credit, allowing you to demonstrate your ability to manage substantial credit obligations with higher fixed monthly payments. By showcasing responsible credit management, your creditworthiness improves significantly, opening doors to better financial prospects.

What makes CS Max stand out:

-

Access to Larger Credit Opportunities

The CS Max account offers accounts reporting up to $25,000 of installment credit, giving you the chance to demonstrate your ability to manage substantial credit obligations. -

Improved Creditworthiness

By making higher fixed monthly payments on the CS Max account, you can significantly improve your creditworthiness, making you a more attractive borrower to lenders. -

Versatile Financial Goals

With a larger credit limit, you have more flexibility in pursuing various financial goals, such as applying for larger personal loans or credit cards with higher credit limits. -

Building Lengthy Credit History

As the CS Max account allows for up to 60 months of payment history, it provides an opportunity to build a lengthy credit history, further strengthening your credit profile.

Which Credit Strong Account Should I Use?

Each account type that Credit Strong offers has the same end goal: to assist you in improving your credit. You can always start with one and add another. The main factor is that you use one of them to start improving and building upon your credit.

Why Choose Credit Strong?

- Transparent and Secure. Credit Strong's affiliation with an FDIC-insured independent community bank ensures the highest level of security and trust.

- Connected to Major Bureaus. Working directly with all three major credit bureaus, Credit Strong provides real-time FICO score monitoring and credit progress tracking.

- Flexibility for All Budgets. With flexible pricing options, Credit Strong accommodates various budgets and financial goals.

- Maximize Credit Potential. Credit Strong's accounts positively impact factors determining 90% of your FICO Score, including payment history, credit mix, and length of credit history.

- Dedicated Support. As an independent community bank, Credit Strong is dedicated to helping you succeed, one strong step at a time.

Building Your Path to Financial Strength

A credit builder loan, combined with the powerful offerings of Credit Strong, can pave the way to financial empowerment. Whether you’re starting your credit journey or looking to improve your credit profile, credit builder loans, like Credit Strong, can be valuable assistants. Through responsible credit management, on-time payments, and savings growth, you’ll not only boost your creditworthiness but also secure a brighter financial future. Take the first step towards building credit and savings today with Credit Strong as your trusted partner. Remember, the journey to financial strength starts with one strong decision.

Start Building Credit Today

- No Credit Check

- Multiple Loan Options

- Build Your Savings

Start Building Credit Today

- No Credit Check

- Multiple Loan Options

- Build Your Savings