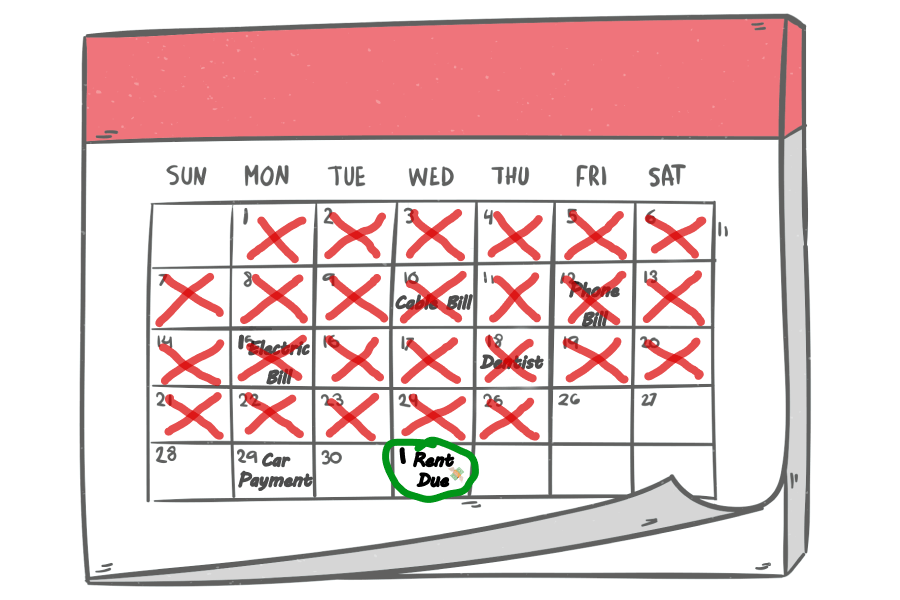

In today’s economic landscape, where unpredictability can quickly change a person’s financial stability, the need for emergency loans for rent has become increasingly crucial for many American households. Growing inflation, rising interest rates, and an overall turbulent economy has left individuals and families grappling with the immediate challenge of meeting their rental obligations.

Unfortunately, rent and housing is typically the largest expense for most households. If you’re on a tight budget, an unexpected expense may mean you don’t have enough to afford rent. We recognize the urgency and complexity of these situations.

Our goal is to present you with the best options for emergency loans for rent, from personal loans for those with a stable credit history to options for individuals with bad credit.

Understanding Emergency Loans for Rent

Emergency loans for rent are short-term financial loans specifically designed to help individuals and families cover rent during financial crises. These loans provide quick funding for those who find themselves unable to meet their rental obligations due to unforeseen circumstances.

Timely rent payments are important for maintaining housing stability and avoiding eviction. Job loss, medical emergencies, or unexpected major expenses are common triggers that disrupt an individual’s ability to pay rent on time. The last thing we want is to not have a place to live, especially if it is because of an unexpected expense.

There are many types of emergency loans for rent. Some are better suited for borrowers with good credit and some are made for borrowers with poor credit that still need the funds.

Evaluating Your Options: Types of Emergency Loans for Rent

Personal Loans

- Personal loans are unsecured loans that can be used for various purposes, including rent payments. Typically, they require a good credit score for eligibility. Personal loans are our recommended option when it comes to emergency loans for rent.

- With fixed interest rates and structured repayment plans, personal loans can be an ideal option for those with stable credit histories.

Payday Loans

- Payday loans are short-term, high-interest loans intended for immediate cash needs. They are secured against the borrower’s future paycheck and are known for their high fees and interest rates.

- Due to their high costs, payday loans should be considered a last resort. They can quickly lead to a debt cycle if not managed properly. We typically recommend other emergency loans instead of payday loans as the APR may be lower.

Cash Advances

- Cash advances provide immediate access to funds but often come with high fees and interest rates. They are typically available even to those with bad credit, all you need is a credit card that allows cash advances.

- While cash advances offer quick cash, the high costs and low funding amounts associated with cash advances make them a less favorable option when it comes to getting emergency loans for rent.

Car Title Loans

- Car title loans use the borrower’s vehicle as collateral. While they provide quick access to cash, there is a risk of losing the vehicle if the loan is not repaid. It is incredibly important that you're 100% sure you can make the loan payments with this type of loan as you don't want to lose your vehicle.

- Due to the risk of losing a valuable asset, car title loans should be approached with caution.

Borrowing from Friends or Family

- Borrowing from friends or family can offer flexible repayment terms and typically does not involve interest. However, borrowing from friends and family can strain personal relationships if not handled properly.

- Clear communication and written agreements can help manage expectations and responsibilities in these informal loan arrangements. Borrowing from friends and family should be approached with much caution. It may be best to explain the circumstances and let them know that they would be helping you avoid having to get an emergency loan for rent.

Credit Cards

- Some renters might consider using a credit card to pay rent. This option can be viable if the renter can pay off the balance quickly to avoid high-interest charges. At the very least, this option buys you more time to make the payments.

- Prolonged reliance on credit cards for rent can lead to high debt and negatively impact credit scores.

Pros and Cons of Each Loan Type

Now that we have covered the different emergency loans for rent available to you, let’s talk about some pros and cons for each type so you can make a more informed decision.

Personal Loans

- Pros: Generally offer lower interest rates and fixed repayment terms, making them predictable and often more affordable in the long run. Suitable for those with good credit scores.

- Cons: May require a longer application process, slower funding, and could lead to more significant debt if larger amounts are borrowed.

Payday Loans

- Pros: Provide quick access to funds, often within 24 hours, with minimal credit requirements.

- Cons: Extremely high-interest rates and fees; short repayment terms can easily lead to a debt cycle, making them less suitable for long-term financial solutions.

Cash Advances

- Pros: Immediate cash availability, often accessible to individuals with bad credit.

- Cons: High fees and interest rates, typically offering only small amounts of funds, which may not fully cover rent needs.

Car Title Loans

- Pros: Quick access to cash using your vehicle as collateral, available to those with poor or no credit.

- Cons: High risk of losing your vehicle if unable to repay, coupled with high-interest rates and additional fees.

Borrowing from Friends or Family

- Pros: Often come with flexible repayment terms and little to no interest, less impact on your credit score.

- Cons: Can potentially strain personal relationships and lack formal lending protections.

Credit Cards

- Pros: Convenient for those who already have a card, with potential rewards and benefits.

- Cons: High-interest rates if the balance is not paid in full, can negatively impact credit scores, and not all landlords accept credit card payments.

How to Choose the Right Loan for Your Situation

Selecting the right loan for rent assistance requires careful consideration of your financial situation and the loan’s terms. Here’s a guide to help you make an informed decision:

1. Assess Your Financial Situation

- Evaluate your current financial status, including income, expenses, and existing debts.

- Determine the loan amount you need and your ability to repay it.

2. Compare Interest Rates and Fees

- Look for loans with the most favorable interest rates and lowest fees.

- Use the personal loan calculator to estimate monthly payments and total interest.

3. Consider the Repayment Terms

- Choose a loan with a repayment schedule that aligns with your financial capacity.

- Longer terms may have lower monthly payments but could result in higher overall interest cost by the end of the loan.

4. Understand the Impact on Your Credit Score

- Consider how taking out a loan might affect your credit score. If you can make all of the payments on time, your credit score may actually improve from the situation.

5. Read the Fine Print

- Carefully review all loan terms and conditions before committing. Look out for any hidden fees or clauses.

6. Explore Alternatives

- Consider other options like debt consolidation if you have multiple debts.

- Look into rent assistance programs if none of these solutions work for you and your situation.

Step-by-Step Guide to Applying for Emergency Rent Loans

Applying for an emergency loan for rent can be a straightforward process if you know the steps to follow. Here’s a step-by-step guide to help you complete the application process:

- Determine the Loan Amount: Assess how much rent you need to cover and any additional fees or expenses. Be realistic about what you can afford to repay to avoid further financial strain. You may also consider taking a loan amount that is equivalent to 2 months of rent just in case you’re unable to recover by next month. Do not take a loan larger than necessary.

- Check Your Credit Score: Review your credit score as it will impact your loan options and terms. Our guide for bad credit can give you some pointers on how to check your score and how to potentially improve it quickly if necessary.

- Research Loan Options: Make sure you look at various lenders to find a loan that offers the best terms for your situation. Doing your research in this scenario can save you a lot of money in the end. Consider factors like interest rates, repayment terms, and eligibility criteria.

- Gather Necessary Documents: Prepare essential documents like proof of income, bank statements, identification, and rental agreement. Check specific lender requirements, as they may vary.

- Complete the Loan Application: Fill out the loan application form, which can typically often be found online for convenience. We provide a quick link to loan applications through our lender list. Ensure all information is accurate to avoid delays in processing.

- Submit the Application and Await Approval: Once your application is submitted, lenders will typically review it and make a decision. Approval times can vary, but some lenders offer quick decisions.

- Review Loan Offer and Terms: If approved, carefully review the loan offer and terms.

- Accept the Loan and Receive Funds: If the terms are agreeable, accept the loan offer. Depending on the lender, Funds are usually disbursed quickly, sometimes within 24 hours. Pay attention to the interest rate, repayment schedule, and any fees.

- Set Up Repayment: Plan for repayment, considering setting up automatic payments if available. Pay attention to the interest rate, repayment schedule, and any fees. Utilize tools like Money4Loans’ budget calculator to manage your finances effectively.

Rent Assistance Programs

While emergency loans offer immediate relief, exploring alternative rent assistance programs can provide sustainable long-term solutions. Here’s an overview of various programs and how to access them:

Government Rental Assistance Programs

U.S. Department of Housing and Urban Development (HUD):

Offers programs for low-income housing, public housing, and Housing Choice Vouchers. For more information on eligibility and application, visit HUD’s official website.

Temporary Assistance for Needy Families (TANF):

Post-pandemic programs like the Emergency Rental Assistance (ERA) offer support for rent and utilities. For application details, visit the ERA program’s official page. TANF Provides financial assistance, including rent, to low-income families. Check TANF’s official website for qualification criteria.

Non-Profit Organizations

Community Action Agencies:

Local agencies provide various forms of assistance, including rent. Find your nearest agency through the Community Action Partnership website.

The American Red Cross:

The American Red Cross Can provide financial support to individuals and families in need of assistance. Check their website to learn more about the program and to see if you qualify.

The American Red Cross also assists individuals and families affected by natural disasters with housing needs. Learn more about their services on The American Red Cross website.

The Salvation Army Family and Emergency Services:

Offers support for basic human needs, including rent, utilities, and food. Visit The Salvation Army’s official website for more information.

The United Way:

Connects struggling renters with local assistance programs. Access their services through The United Way’s official website.

Religious Organizations:

Many religious groups provide community aid, including rent assistance. Start your search online or through local community centers. Check if your local church has any resources that you can use.

Communicating with Your Landlord

If you’re facing temporary financial hardship, consider discussing your situation with your landlord, they might be willing to provide you with some options to help you out. At the end of the day, if you don’t pay your rent, your landlord loses money. Negotiating a payment plan or an extension can provide temporary relief. Make sure you fully understand your rights and responsibilities as a tenant to make informed decisions.

Managing Your Loan Responsibly

Effective loan management is important for avoiding further debt.

Develop a clear plan for how you’ll repay the loan. Consider using tools like Money4Loans’ monthly budget calculator to organize your finances. Prioritize loan repayment in your budget to avoid missing payments. Loan payments and expenses required to survive should go in your budget first. You may need to look for areas where you can cut back to make sure you can pay off your debt on time.

Make sure you fully understand the terms of your loan, including interest rates, fees, and the repayment schedule. If anything is unclear, don’t hesitate to ask the lender for clarification.

Consider setting up automatic payments to ensure you never miss a due date. This can also sometimes reduce the interest rate since certain lenders offer discounts for automatic payments. Check if your lender offers any incentives for automatic payments.

Try not to take on new debts while repaying your emergency loan. Additional loans can complicate your financial situation. Focus on paying off your current loan before considering additional borrowing.

Start setting aside a small amount regularly to build an emergency fund. This can provide a buffer for future financial emergencies. With an emergency fund, you can avoid scrambling to get a loan to pay rent in the first place.

If you’re struggling with loan repayments, consider seeking advice from a financial counselor.

Conclusion

Securing an emergency loan for rent can provide crucial assistance when you’re in a pinch, but it’s important to approach this decision with care and consideration.

We hope that this article provided you with a variety of options and solid information for your to make the correct decision based on your unique situation. We understand that needing to take a loan out to pay for rent is unfortunate, but we believe in you. If you have any questions for us, leave us a message!

Compare Top Lenders

Get cash not rejected

Compare Top Lenders

Get cash

not rejected

FAQs on Emergency Loans for Rent

What are the eligibility criteria for emergency rent loans?

Eligibility varies by lender, but generally includes factors like credit score, income stability, and employment status. For specific requirements, refer to our emergency loan applications guide.

How quickly can I get an emergency loan for rent?

Many lenders offer quick processing, with some providing funds as soon as within 24 hours. For more details on the speed of loan disbursement, visit How Fast You Can Get an Emergency Loan.

Are there alternatives to high-interest emergency loans?

Yes, alternatives include personal loans from banks or credit unions, borrowing from friends or family, or seeking assistance from rent relief programs. Explore emergency loan alternatives for more options.

How do I avoid predatory lenders when seeking an emergency loan?

Research lenders thoroughly, read loan terms carefully, and be wary of offers that seem too good to be true. Customer reviews can also help guide you in your research.

Can emergency rent loans impact my credit score?

Yes, like any loan, they can impact your credit score. Timely repayments can improve your score, while late or missed payments can have a negative effect. Learn more about credit scores on our mastering credit page.

What should I do if I'm struggling to repay my emergency rent loan?

Contact your lender to discuss potential options, such as restructuring your loan. Additionally, consider seeking financial counseling for guidance. Check out our resources on loan repayment strategies.